A better future for advisors starts here

Savvy's modern RIA brings in-house technology and expert operations together so your practice can thrive.

$3B

AUM

80+

advisors

Up to

19 hours

per week saved on manual workflows

Independence without compromise

Savvy’s all-in-one RIA platform gives you the technology, tools, and support you need, without ever compromising your independence.

True independence

Whether you use your own brand or ours, manage investments yourself or let us do it, Savvy gives you the freedom to run your practice your way.

Win back your time

Offload busywork and operational tasks you dread (like compliance) to Savvy’s expert back-office team, so you spend less time working in your business and more time growing it.

Accelerate growth

Get expert marketing help from our in-house agency and an AI-powered CRM, built specifically to help you attract clients, deepen relationships, and grow faster.

Next‑gen technology

Developed side by side with advisors through continuous feedback and engineered by top Silicon Valley talent, Savvy’s platform puts an AI-powered CRM, seamless digital onboarding, intuitive client dashboards, and more at your fingertips.

Earn more. Keep more.

Keep more of what you earn with Savvy’s industry-leading payouts, without getting nickel-and-dimed for support or features.

Your way, powered by Savvy

Choose Savvy branding or your own, use our portfolios or your own investment strategies, leverage personalized investment and marketing support.

At Savvy, you’re free to run your business your way.

Who you are

RIA Owner

Universal Value Advisors and owner Josh Barone retained their brand and office while running their practice with the support of Savvy’s marketing and operations platform.

Owned RIA

Powered by Savvy

National or Local RIA

Cindy Alvarez and Janelle van Meel broke away from a local RIA to accelerate their growth. Janelle and Cindy run their Colorado office under the Savvy brand, tapping into our marketing and operational support to grow their book with less stress.

Local RIA

Savvy Advisor

Independent Broker-Dealer Platform

Michael Most grew tired of life at LPL and wanted a clean break from the broker-dealer channel. He was frustrated that he was nickled and dimed by his firm. Since moving to Savvy, he now has the independence to do what he believes is best for the families he serves.

LPL

Savvy Advisor

Bank or Wirehouse Breakaway

Louis Green built his career at Deutsche Asset & Wealth Management, PNC, and UBS, but tired of the wirehouse grind, he joined Savvy to take control of his future. Leveraging Savvy's brand, operational support, and institutional-quality investment strategies, Louis now owns his book, and his destiny.

UBS

Savvy Advisor

Why top advisors choose Savvy

Watch this short video to see why 60+ advisors have chosen Savvy to power their practice.

Spend your day on growth,

not busywork

Our operations team takes care of onboarding, billing, and compliance so your hours go to clients and revenue, not routine administration.

Your Savvy Onboarding Team handles every transfer form, custodian call, and client update for you. They turn client transitions into a smooth, white-glove experience that keeps relationships strong and momentum rolling.

Savvy’s compliance team keeps you ahead of SEC exams and ADV updates. Get plain-English rule alerts and lightning fast marketing reviews.

Your Client Servicing Associate can help you process money movements, beneficiary updates, address changes, monitor cash balances, queue up required distributions, and handle common client requests such as "Can you send me my tax statements?"

Our investment operations team handles all ongoing portfolio management - such as rebalancing, tax-loss harvesting, cash management, and ongoing oversight - so you can stay focused on your clients.

Our SWIM desk provides institutional-grade model portfolios that are continuously researched, stress-tested, and refined by dedicated strategists. Plug into these ready-made, risk-aligned strategies to improve client outcomes while leveraging our investments team, avoiding the cost of hiring dedicated staff or expensive third party managers or models.

Dedicated marketing to

fuel your growth

Full service marketing support for advisors turns proven strategies into growth, giving you expert creative, PR muscle, and lead generation without added cost.

Strategy built around you

From day one, we help you craft a marketing strategy that spotlights your strengths and attracts your ideal clients.

Results:

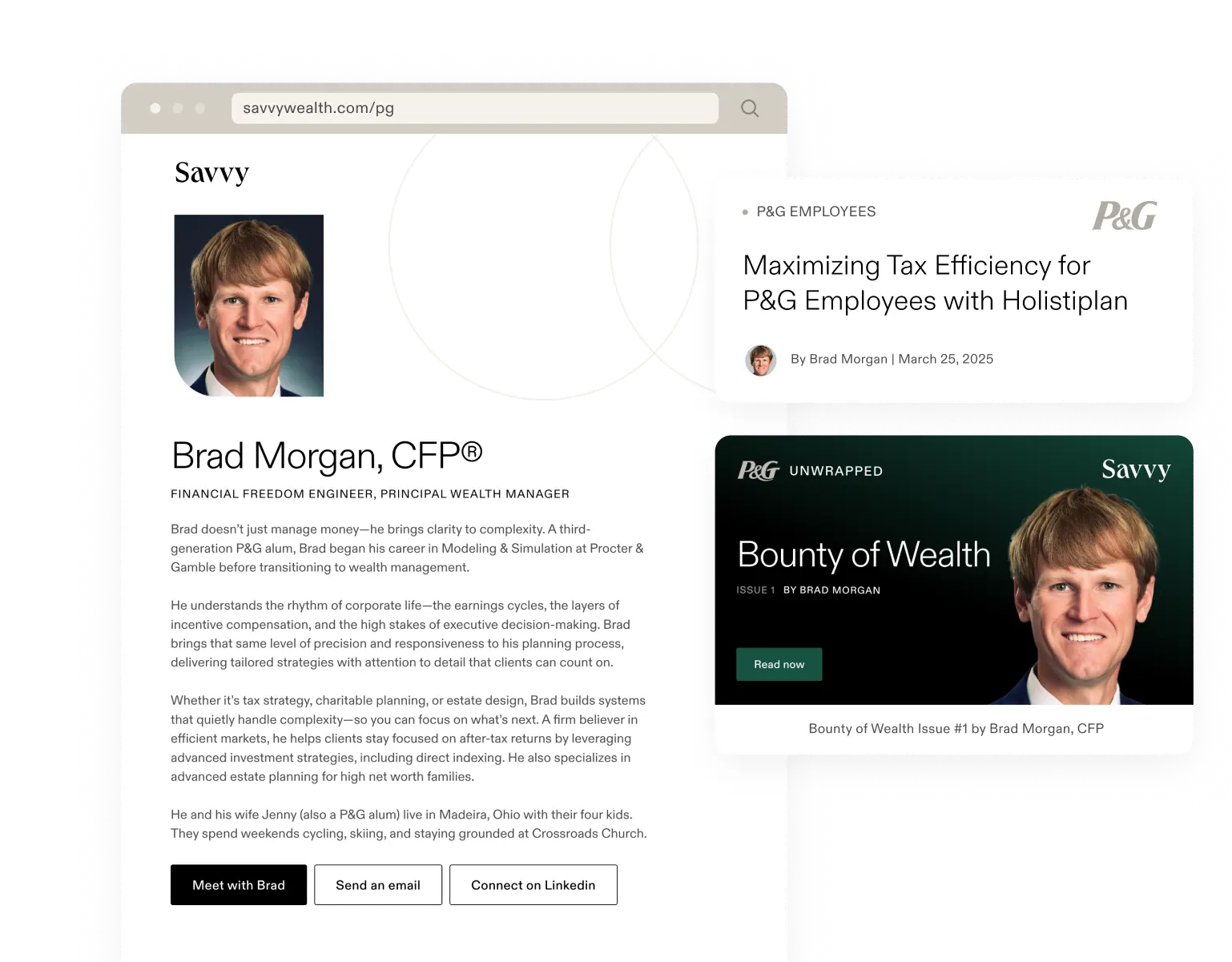

Brad Morgan grew up in a P&G family and now guides current and former P&G employees on building lasting wealth.

We helped craft a marketing strategy dedicated to helping Brad reach these P&G employees including building a dedicated microsite, blog content, LinkedIn newsletters, webinars, and more.

Get featured in top national media

Our communications team pitches your expertise to top outlets and handles every detail of the process.

Results:

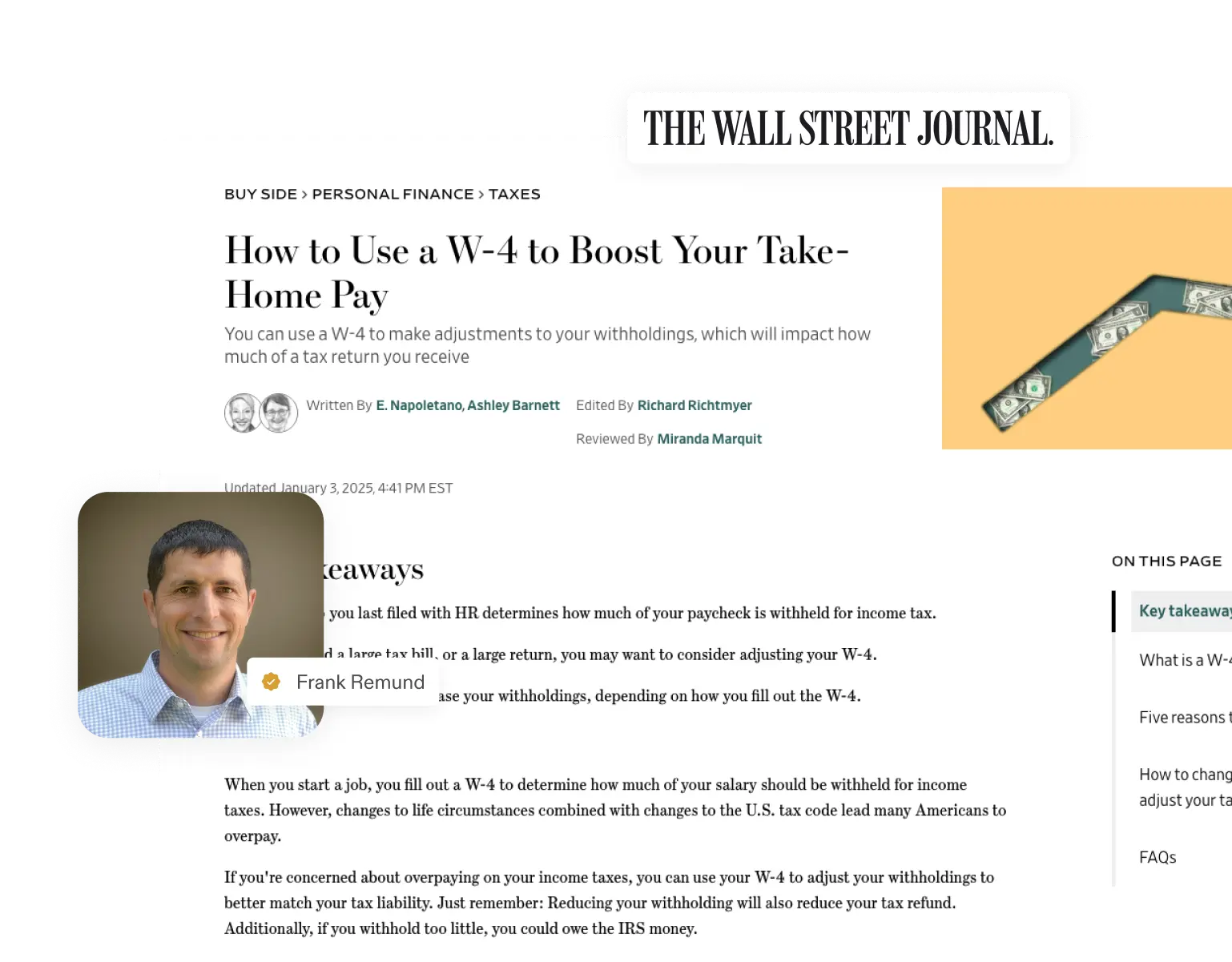

Advisors have earned bylines and quotes in U.S. News & World Report, CNN, and The Wall Street Journal, including Frank Remund’s spotlight in “How to Use a W-4 to Boost Your Take-Home Pay.”

Custom content that drives engagement

From email sequences to niche blogs, we help write pieces that sound like you and attract the clients you want.

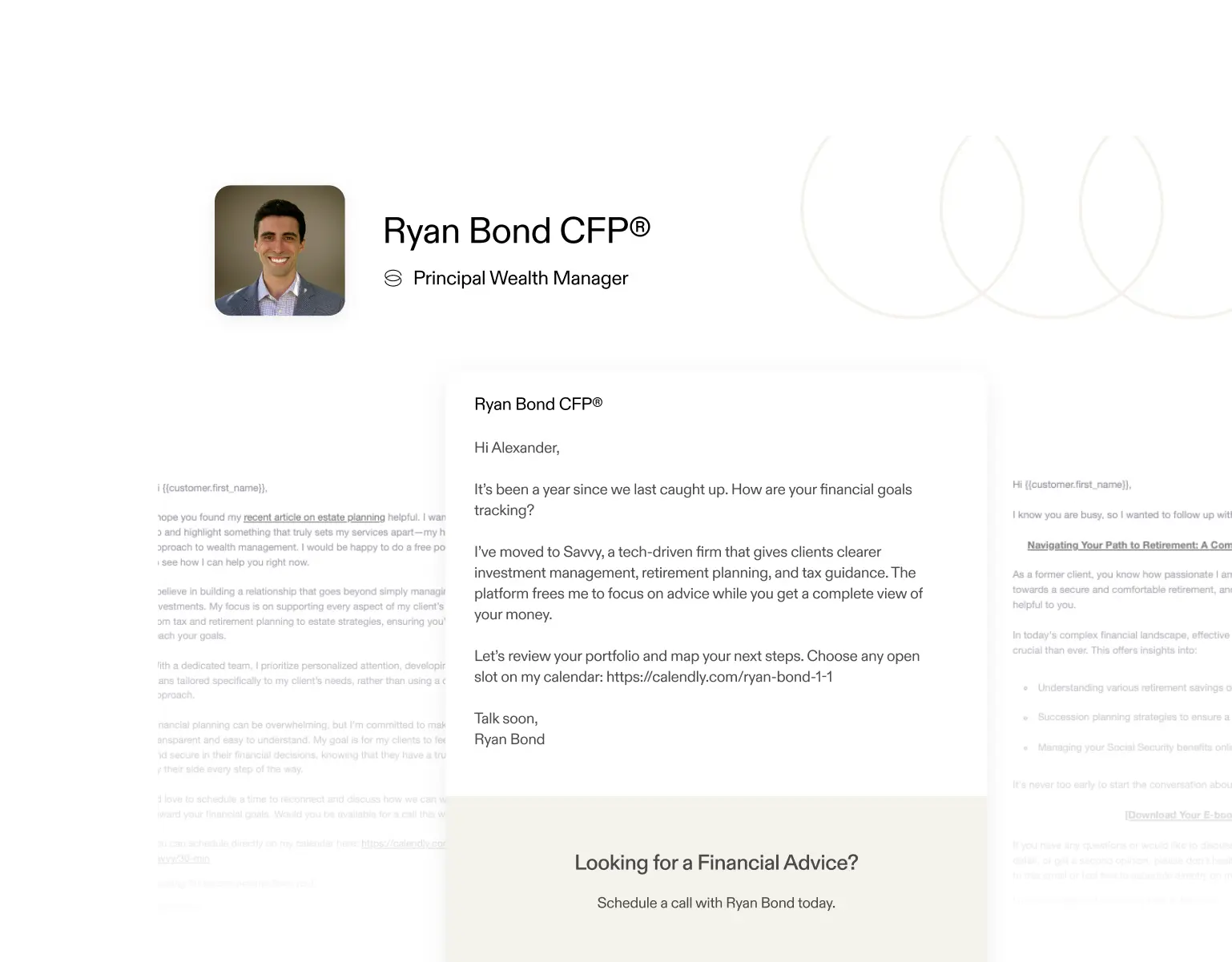

Ryan Bond asked us to win back dormant accounts. We built a six-email drip that mixes quick-hit posts with deeper guides on estate planning, retirement readiness, and big financial moves.

Results:

40% open rate

2 client signed

3 qualified leads

20 hours saved

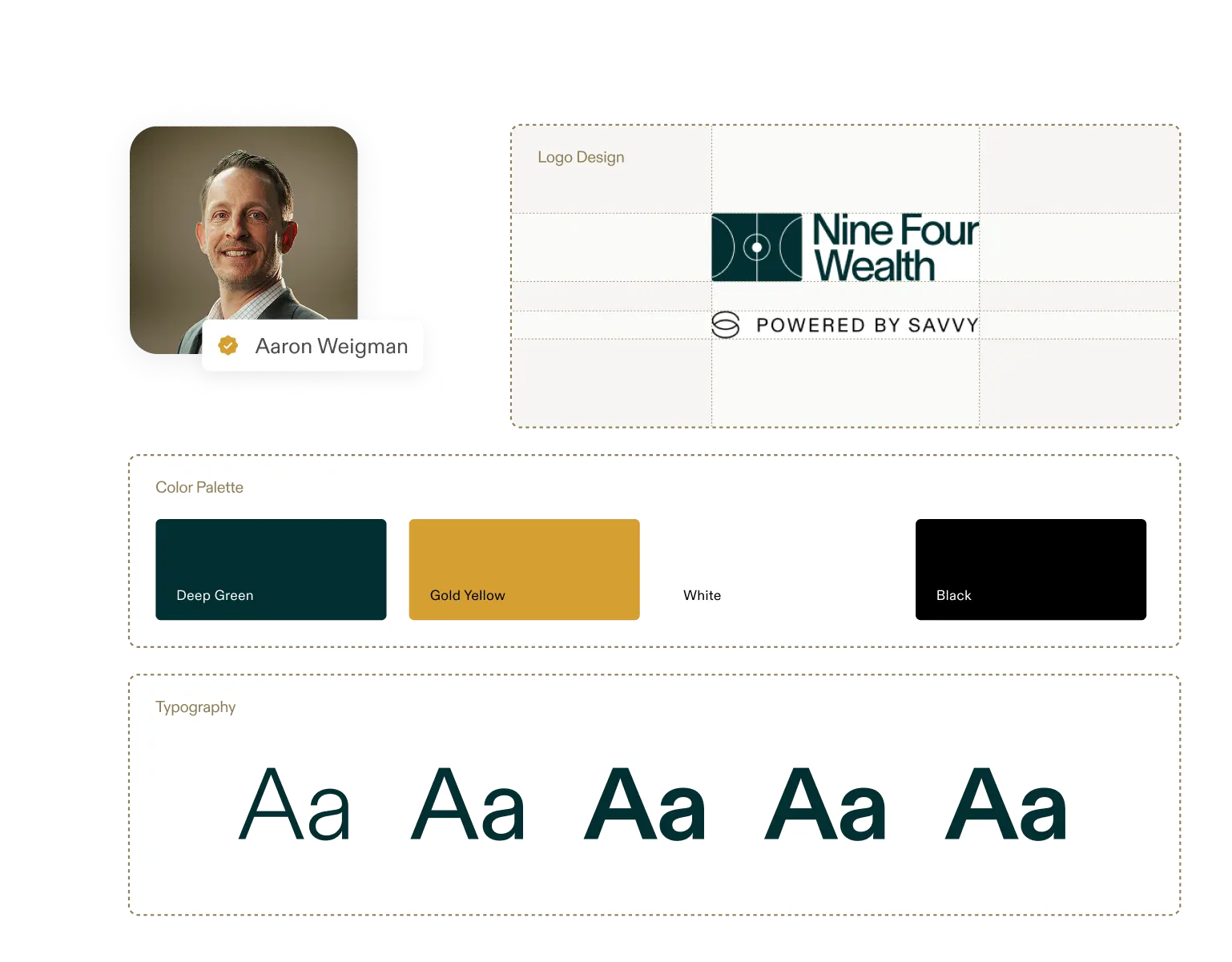

Brand and logo built for you

Keep your identity or launch a fresh one, either way our creative team work with you on a standout name, logo, and voice that fit your market and personality.

Results:

80

hours saved

Always-on lead generation that delivers

Our team manages ongoing Google Ads, LinkedIn campaigns, SEO, and webinar funnels that get prospects on your calendar.

We tune spend, keywords, and creative, so you meet qualified prospects while we handle the heavy lifting.

Modern technology that

gives you time back

Swap faxes for modern tech built in-house by former Facebook and Airbnb engineers, helping save you hours each week with smart AI workflows.

Never type notes again

Forget typing; our AI note-taker delivers clear notes and next steps so you can move to your next client call without forgetting anything.

CRM purpose-built for advisors

Every call, text, and email auto-logs, AI surfaces next steps, you stay compliant without extra work.

Digital onboarding, less paperwork

AI pre-fills forms, with human verification from our operations team, so your clients simply e-sign and onboarding takes 5 minutes instead of days.

Stay ahead of every service milestone

Set each task’s cadence once or per client, and our Service Calendar builds the schedule for you. Timely reminders keep you proactive, strengthening every client relationship while freeing up your focus.

Dashboard and app clients love

Clients can view live net worth, performance, and secure uploads in one elegant hub that makes you the advisor they rave about.

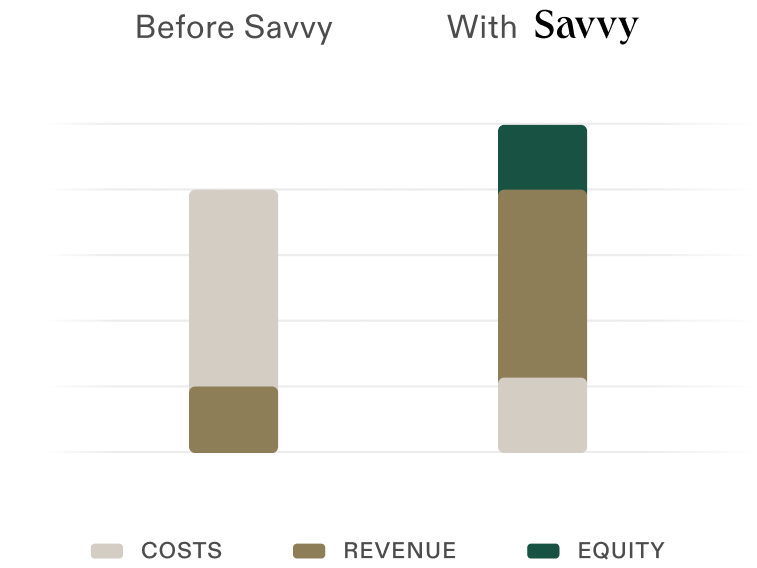

Keep more of what you earn

Keep more of what you earn with Savvy’s industry-leading payouts, supported by smart technology that delivers better service and efficiencies, without extra charges.

You are an owner at Savvy

At Savvy, all of our advisors have equity, because we are all driving toward the same long-term vision, to reinvent wealth management.

Your future starts now

Take the next step with Savvy Wealth. Discover how our innovative technology, streamlined operations, and unmatched support can help you grow more and keep more.

FAQ

Advisors partner with Savvy as independent contractors on a 1099 basis. There are no upfront fees, platform subscriptions, or direct costs to join Savvy. We operate on a partnership model, so our success is directly aligned with yours.

Our partnership is based on a transparent revenue-share model. In addition to the revenue share, all partner advisors receive equity in Savvy. We believe every advisor should be an owner and share in the company's long-term success.

Savvy partners with financial advisors by providing them with the full-service middle and back-office experience designed to help them run their business without managing overhead.. As part of Savvy, you will have access to our proprietary, technology-powered platform that powers your entire business. Additionally, you will have dedicated human support for both servicing your clients and growing your business, operations, client services, back-office, and marketing processes. All of this is provided to better allow advisors to focus on what they do best — advising clients.

Savvy provides a comprehensive support platform so you can run your practice without the headache of managing overhead. We handle the middle and back-office functions for you. Your partnership includes:

- Proprietary Technology: Full access to our integrated platform that powers your entire business.

- Dedicated Support Staff: A dedicated team for client servicing, investment operations, and marketing. This structure frees you up to focus on what you do best: advising clients.

Yes, absolutely. We provide dedicated support staff who act as an extension of your team. You'll be assigned specific team members for client servicing, investment operations, and marketing. This ensures you work with the same people who understand you and your practice, providing a consistent and familiar experience for both you and your clients.

No. You own your client relationships, period. We are your partner, not your owner. We earn your partnership by providing outstanding value and support—not by locking you into restrictive contracts. If you ever decide Savvy is no longer the right fit, you take your clients with you.

Yes, this is a common situation, and we're perfectly structured to support it. Our model allows you to operate as a true 1099 independent contractor, giving you greater autonomy and the significant tax advantages that come with it. At the same time, we provide access to enterprise-grade benefits, such as health insurance and retirement plans, through our platform partners. This gives you the best of both worlds: the support and benefits of a larger firm with the freedom and financial upside of being an independent business owner.

No, you have complete flexibility with your branding. We offer two options to fit your business goals:

- Maintain Your Own Brand: Operate under your own DBA ("Doing Business As"). We'll provide all the technology and back-office support seamlessly behind the scenes, with a "powered by Savvy" disclosure for compliance.

- Leverage the Savvy Brand: If you prefer not to build or maintain your own brand, you can operate as a Savvy advisor and benefit from our established name and marketing resources.

The choice is entirely yours.

Yes, absolutely. We specialize in helping advisors transition from captive models like wirehouses to true independence. Our platform is specifically designed to handle every aspect of the move, providing a full-service support system for:

- Technology & Operations: A fully integrated tech stack from day one.

- Compliance: Guided oversight to ensure a smooth and compliant transition.

- Marketing: Support to re-establish your brand and communicate the move to your clients.

We manage the complexities of breaking away so you can focus on what matters most—serving your clients without interruption.

Great question – we have a full breakdown for how we save our advisors up to 19 hours a week here.